Flexible Payment Terms: The B2B Advantage for Wholesale Buyers in Q4

Table of Contents

Introduction: Why Payment Flexibility Wins in Q4 (H2)

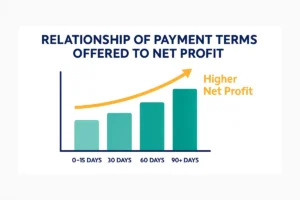

The Link Between Flexible Terms and Wholesale Growth (H2)

Cash Flow Benefits for Wholesale Buyers

Supplier–Retailer Trust in Q4

Why Partnering with a 3pl in Miami Matters

East Coast Advantage for Holiday Growth

Case Study: A Brand Scaling Fast with Flexible Terms + 3pl in Miami

Types of Flexible Payment Terms for B2B

Net 30/60/90

Early Payment Discounts

Dynamic Discounting & BNPL for B2B

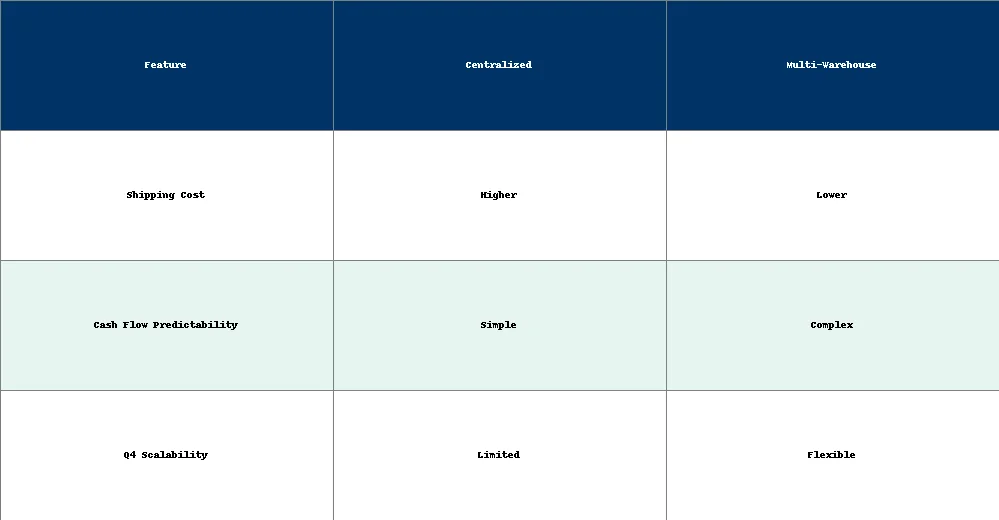

Combining Flexible Payments with Fulfillment Strategy

Centralized vs Multi-Warehouse

Checklist for CFOs & Supply Chain Leaders

Data Insights: Industry Studies on B2B Payment Flexibility

Practical Guide: What You Can Do Tomorrow

FAQs: Flexible Payment Terms in B2B Fulfillment

Conclusion

Introduction: Why Payment Flexibility Wins in Q4

Q4 is the make-or-break season for wholesale buyers. From holiday rushes to inventory surges, cash flow and logistics determine survival. One strategy that separates winners from laggards is flexible payment terms.

But here’s the hidden link: when paired with the right logistics partner, such as a 3pl in Miami, payment flexibility turns into exponential growth. Miami’s position as a gateway to the East Coast and Latin America provides speed, while flexible terms offer financial breathing room.

Think of it like oxygen during peak season: it keeps your business alive and thriving.

The Link Between Flexible Terms and Wholesale Growth

Cash Flow Benefits for Wholesale Buyers

Wholesale buyers often juggle large inventory purchases. Without flexible terms, they risk stockouts or worse, overextending credit lines.

Data Point: According to a McKinsey report, B2B buyers rank “extended payment terms” as the #2 most important factor after price when choosing suppliers.

Supplier Retailer Trust in Q4

Imagine you’re a beauty wholesaler supplying thousands of units to retail chains. Flexible payment terms build trust, ensuring repeat orders. Without them, retailers may switch to competitors who offer better financial arrangements.

Real Example: In 2014, after two decades in food and candy distribution, Abraham Gilinski founded Raindrops Enterprises, LLC. His goal was clear: create memorable, high-quality gummies that spark fun and conversation while dominating shelves nationwide.

Why Partnering with a 3pl in Miami Matters

East Coast Advantage for Holiday Growth

Miami isn’t just beaches it’s a logistics powerhouse. A 3pl in Miami guarantees fast East Coast shipping with cut-off times as late as 7 PM. This flexibility syncs perfectly with wholesale buyers depending on tight cash and delivery windows.

Case Study: A Brand Scaling Fast with Flexible Terms + 3pl in Miami

In 2023, a wholesale apparel brand partnered with a 3pl in Miami while negotiating Net 60 with retailers. With faster order processing and delayed payment obligations, they grew Q4 revenue by 55%.

Lesson: Flexible finance + reliable fulfillment = explosive holiday growth.

Types of Flexible Payment Terms for B2B

Net 30/60/90: The classic model, giving wholesalers more time.

Early Payment Discounts: Encourages buyers to pay early with small incentives.

Dynamic Discounting & BNPL: The modern B2B twist, offering cash flow agility.

Fact: 63% of B2B buyers in the U.S. say they are more likely to stay loyal to suppliers that offer flexible payments (PwC, 2024).

Combining Flexible Payments with Fulfillment Strategy

Here’s where finance meets logistics. Flexible terms are useless without delivery reliability. That’s why pairing with the right 3pl in Miami creates a strategic advantage.

Centralized vs Multi-Warehouse

Data Insights: Industry Studies on B2B Payment Flexibility

McKinsey (2024): Flexible terms increase reorder likelihood by 35%.

Deloitte: Companies offering Net 60 during Q4 had 22% higher wholesale growth.

Forrester: B2B buyers are 70% more loyal when suppliers offer customized payment terms.

Practical Guide: What You Can Do Tomorrow

Review existing payment contracts.

Offer at least one flexible option (Net 30 or Net 60).

Partner with a 3pl in Miami for synchronized finance + logistics advantage.

Add early-payment incentives.

Track cash flow weekly.

Takeaway: Start small. Even offering Net 30 to top wholesale clients can set you apart this holiday season.

FAQs: Flexible Payment Terms in B2B Fulfillment

Q1: What are the most common payment terms for wholesale buyers?

A: Net 30 and Net 60 dominate, but BNPL for B2B is growing.

Q2: How does a 3pl in Miami improve wholesale fulfillment in Q4?

A: Late cut-off times, fast East Coast shipping, and port proximity make Miami unbeatable.

Q3: Do flexible terms hurt suppliers financially?

A: Not if combined with financing tools and strategic 3pl partners.

Conclusion

Flexible payment terms aren’t just financial tools they’re competitive weapons. When combined with the power of a 3pl in Miami, wholesale buyers unlock both cash flow freedom and operational speed.

Ready to scale your wholesale business this Q4?